Average tax deduction per paycheck

Web Local Income Tax. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

2022 Federal Payroll Tax Rates Abacus Payroll

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

. Home financial take-home. In addition to federal income tax you will also have to pay state income tax and any other local income taxes like those for city or county. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Within this income segment the average annual income tax paid was. Web Indexed brackets and other provisions to the Chained Consumer Price Index C-CPI measure of inflation including the standard deduction which for 2020 stands at. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

On the new W-4 you can no longer claim allowances as it instead. Web Based on a survey of 2100 employees at non-federal public and private companies KFFs 2017 Employer Health Benefits Survey finds that the average worker. Web If youre single and you make 50000 after subtracting deductions exemptions etc you would pay.

Web From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. See where that hard-earned money goes - Federal Income Tax Social. Luckily there is a deduction to help you pay this.

Sign Up Today And Join The Team. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Web The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Some deductions from your paycheck. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. You pay the tax on only the first 147000.

Web Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Web How to calculate annual income. That means that your net pay will be 43041 per year or 3587 per month.

Learn About Payroll Tax Systems. Web If you make 55000 a year living in the region of New York USA you will be taxed 11959. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Web If you are self-employed you are responsible for paying the full 29 in Medicare taxes and 124 in Social Security taxes yourself. Web The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. Learn More at AARP.

Web Over the last few years withholding calculations and the Form W-4 went through a number of adjustments. 10 on the first 9700 970 12 on the next 29774. Web The most common adjusted gross income in the US fell between 50000 and 75000 in 2018.

For example if an. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss.

Mary Kay Marketing Plan Sheet Perfect For Team Building Opportunities Find It Only At Www Thepinkbubble Mary Kay Marketing Mary Kay Business Selling Mary Kay

Pin On Free Salary Slip Template

The Irs Collects 3 Types Of Payroll Taxes Future Systems

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Income Tax Calculator Python Income Tax Income Tax

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

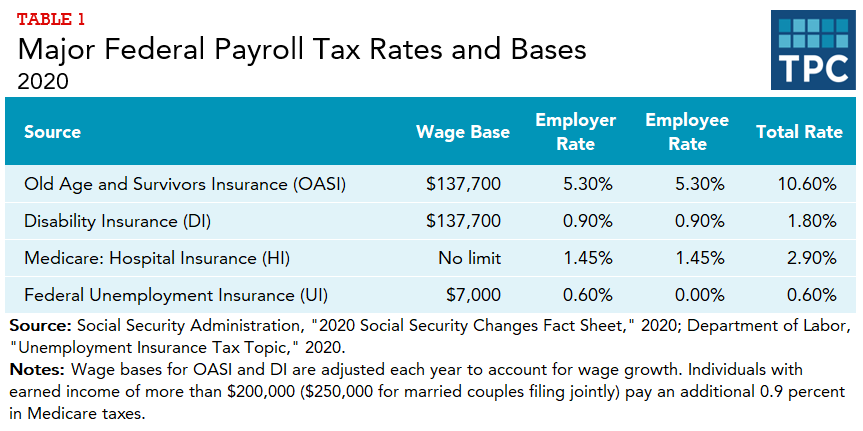

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2022 Federal State Payroll Tax Rates For Employers

Save Taxes Now Tax Services Advisor School Logos

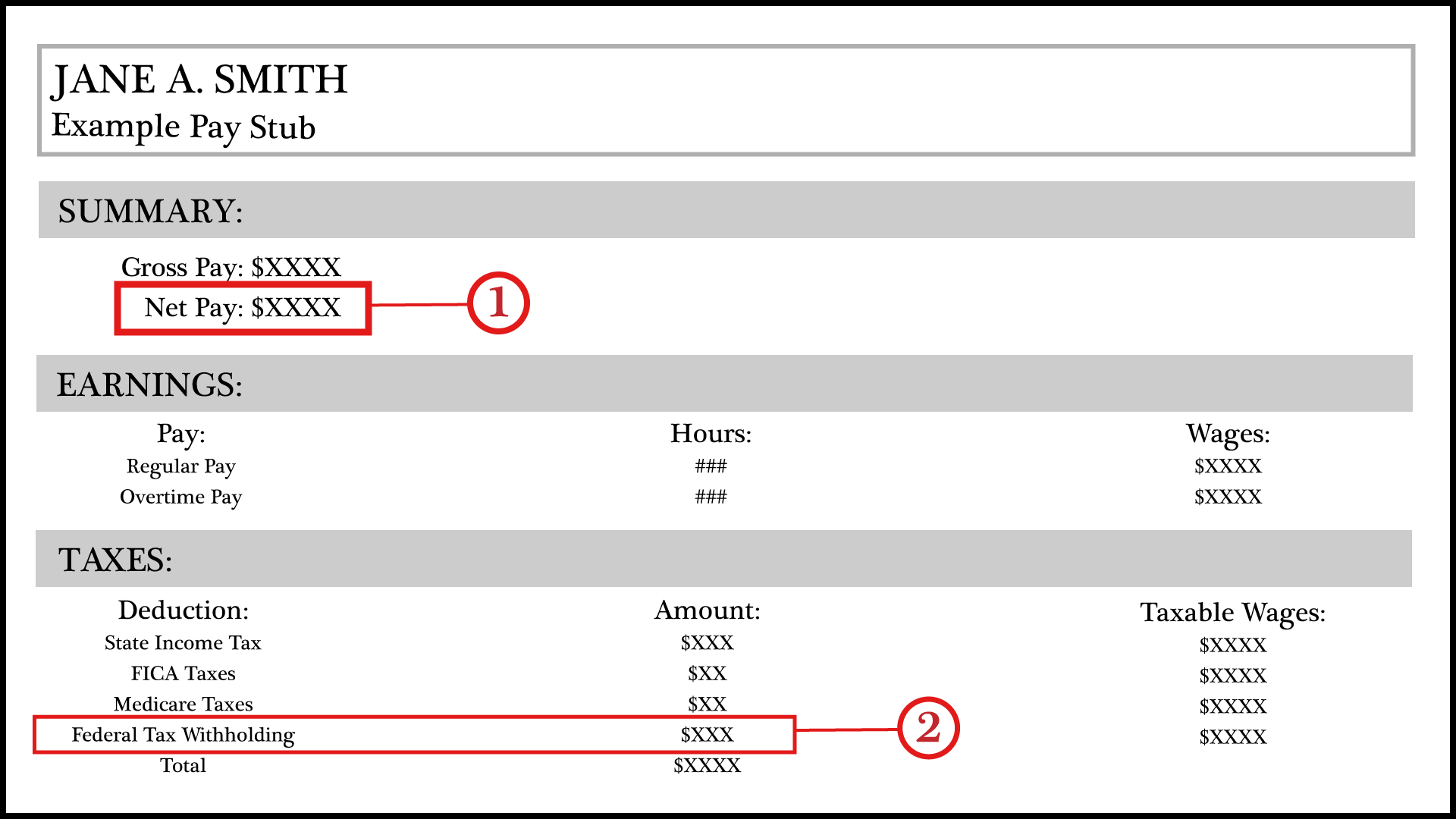

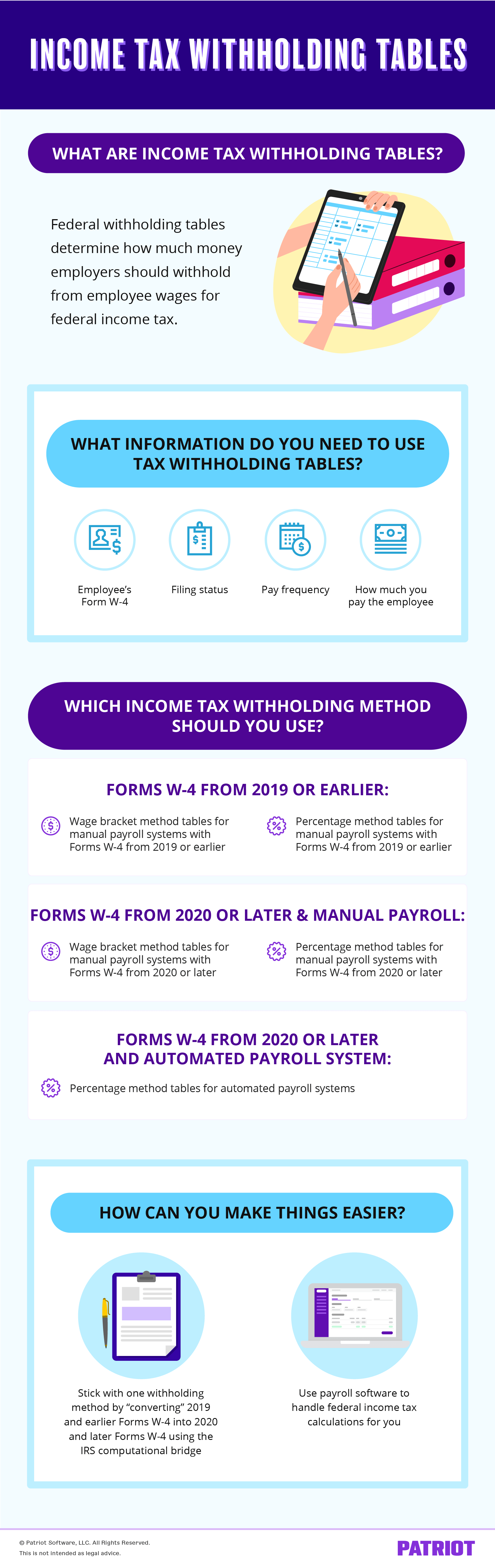

2022 Income Tax Withholding Tables Changes Examples

The Stock Market Has Not Been This Richly Valued Or Avidly Loved In Two Years Stock Market Investing Dow Jones Industrial Average

2022 Federal State Payroll Tax Rates For Employers

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Different Types Of Payroll Deductions Gusto